Bitcoin has been around since 2009 and Ethereum since 2015. And there are thousands of other cryptocurrencies – or cryptos for short. Many of them died during the alt-coin apocalypse. Others have managed to hodi on and barely keep themselves afloat.

Not every digital token is a cryptocurrency.

Some are security tokens – typically backed by real-world assets.

Others are nothing more than glorified loyalty points that have zero underlying value – and yet, some people are still willing to buy and sell them for real money.

Cryptocurrencies were intended to be the ‘people’s currency’. Records were to be kept in a way that was decentralised, distributed and immutable. The entire network, including the ledger data, was to be fully transparent and open for inspection by anyone as part of the architecture of trust.

Bitcoin has a market cap today of $183,176,653,494. That’s $183Bn. So what. 4% of those addresses own 95% of that market cap. So much for being decentralised!

With such a tiny number of wallets holding all of that value, the chance for market manipulation is massive. The idea that bitcoin is a haven for stock market volatility – a non-correlated asset – is being disproved every passing day.

Bottom line: Bitcoin was great for some early adopters and tech-savvy speculators. Institutional investors are still incredibly wary (with very good reasons) because ultimately bitcoin has no inherent value – and neither does it have backing by the state or achieved any utility in the market.

Why are cryptos a waste of time?

- No one needs them. Cryptocurrencies, in their current form, do not solve a problem. Consumers are perfectly happy trusting their bank with their money. (Except in some extremely volatile markets).

- The user experience for crypto is horrific. No one understands public and private keys. They hate the accountability that comes with having no one to call if you lose your keys or your password. They hate the volatility of the price. They can’t find merchants who will accept the currencies because of the volatility. The transaction speed is slow, and the transaction cost is variable. These limitations apply to bitcoin, ethereum and any other crypto out there trying to position themselves as a ‘fiat killer’.

- They are lousy for securing investment. Even after the car-crash-TV series of events in 2017, there are still people trying to raise money with crypto. Initial Coin Offerings (ICOs) became Security Token Offerings (STOs) and then ‘evolved’ to Exchange Token Offerings (ETOs). At every step away from the nirvana of an unregulated ICO, it became more and more apparent: It is easier to raise funds traditionally.

ICOs are inherently worthless.

They’re nothing more than people giving money to a project and then trying to find a secondary market to dump their tokens. STOs are backed by shares in the company, but often give you far less control than actual (ie real) share ownership. And ETOs were just pumped up STOs supported by an exchange – basically, a traditional IPO with a book that makes only the uber-rich richer.

- People who buy tokens today have no idea what they are doing. And when the price tanks they freak out. And all they hear back is, “Hey. It’s Crypto. You knew what you were getting into.”

The average retail investor wants a tip from Jenny or Robert down at the pub as to what crypto to buy so they can get rich. They don’t want to take time to investigate what they are buying or the mechanics of the market or the risks involved. Depending on the crypto, many are unregulated. No regulation means no safety net. As much as people want to moan that the financial products that make the most money are exclusively accessible by the rich, it’s the rich who also take the risk when the price tanks.

- The hype can be deafening. The best things in the world grow organically. Crypto is a whole different kettle of fish: It’s all about the shills and the shysters. There are plenty of people who will debate if any given crypto is a Ponzi scheme. Truly decentralised there is no ultimate winner so in that way it fails. But if you look at the behaviour of everyone else who is “in the tent”, all they can do is shout about how amazing things are going to be. Why? Because they know they need more people to come in and to buy so the value of their tokens goes up.

To be clear: There is nothing about crypto that is “investing”.

An analogy is people randomly buying tokens, for a laundromat that hasn’t been built, in a neighbourhood that doesn’t need a laundry, by people you don’t know and hoping to sell those tokens for more than you paid before someone figures it all out!

5. There isn’t any liquidity. Aside from bitcoin and ethereum – and perhaps one or two others – there isn’t nearly enough liquidity in the market. There are too many exchanges that do not share liquidity pools. Companies or projects behind smaller coins add and remove liquidity to manipulate the price. If you’re not going to hodl you’re screwed. And with the current financial situation from the double threat of both COVID-19 and Brexit, people are going to want their fiat back to pay for things like their mortgage. (FYI, your bank won’t take your crypto).

Crypto currency is not backed up by anything.

The price of any crypto coin will only go up if someone buys the coin.

If a lot of coins are bought it can go way up.

If a lot of people sell the coin it can go way do fast.

Crypto currency is mainly used by people to try and make a buck fast.

Is it worth what the coin is selling for?

Maybe for that moment. The next moment it could be worth almost nothing.

People buy and sell crypto currency like day tranders of stock.

If you own some crypto currency thats listed for sale on an exchange and don’t own much of it your at the mercy of the day trader crypto coin buyers and sellers at any moment.

If you own a lot of it your still at the mercy of those who also own the coin and want to make a quick buck.

To make a crypto coin using some dapp you have to pay and amount to make it plus gas fees.

Once you make the coin if you have not invested in the coin it won’t be listed on exchanges for other to buy or sell.

I have made a couple of actual crypto coins to learn about the blockchain and crypto stuff.

The crypto coins I made do have contracts listed on a blockchain.

I am the only one who can buy one of the coins. I can’t sell it.

Its basically worth NOTHING!

If and until more people buy my coins, then I could get my coins listed on some exchanges I could possibly trade them.

I know my coins are bascially worthless.

I know they will never be listed on an exchange to buy or sell.

I didn’t make my crypto coins and NFT’s thinking they would ever be worth anything.

I made them to learn what crypto block chain stuff was about.

I found out its very complicated and just like stocks its mainly for the big boys to use to make money trading.

You can buy one of my NFT’s but not the crypto coins I made.

What are the NFT’s I made worth?

An example would be:

You buy $10.00 worth of one of my NFT’s.

You “mint” $10.00 worth of and NFT I have created.

You only have $10.00 worth of the NFT and can’t sell it.

You can only “mint” it which means your have it made but can’t sell it.

But you have go $10.00 worth of my NFT.

Wow!

Same thing if your created your own NFT.

So buying a crypto coin or an NFT token thats not listed, like mine, is not a good investment at all.

Hey if you want to buy my NFT Token go ahead.

You can tell your friends, hey look at this NFT token I bought.

You don’t have to tell them you can’t sell it.

The NFT tokens I have created are not scam items.

They are not an investment.

Their just something to buy and own for your own purpose.

CREATING AN NFT TOKEN FOR A MEMORIAL IS NOT A WASTE OF TIME OR MONEY.

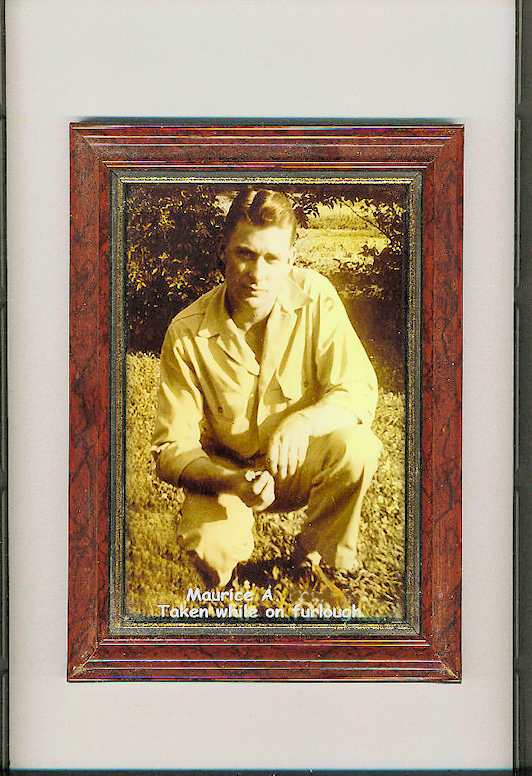

I made several A-11 watch tokens to honor my dad who repaired watches in WW2.

I am glad I did.

I own a few of these NFT Memorial Tokens.

It was fun to make them and learn the story about the A-11 WW2 famous watch.

So if there is a reason to make an NFT token, this is a good one.

A memorial NFT token for my dad.

https://audaciouscat.com/rabbit/wwii-watch-a-11-hack-crypto-coin-01-12-2025/

Have I given you an idea?

Its hard to get a do it yourself crypto coin on any exchange because it won’t be listed unless you have initially put a lot of money into it.

Its called liquidity.

If you invest in your own crypto coin your taking a gamble that you can sell it in the future and also that people will buy it in the future.

Making your own crypto coin is a waste of time.

Unless your a scam artist, a whale, and make a crypto coin, invest in it, get it listed on some exchanges and try to sucker other people into buy the coin.

So you hype the coin or NFT token and get people to buy the coin or NFT token.

Remember your the biggest investor of the coin, the whale.

So you wait until enough people are suckered in to buying your coin.

Your coin goes up either because you keep buy it.

You sucker in others to buy the coin.

Lets say your put $5,000 into you cryto coin.

One thousand 5 times.

People see the “value” go up and think, wow I am going to buy this coin because it

keeps going up in value.

A few hundred suckers buy your coin.

It has gone up in “value” because you and others have bought the coin.

It was worth 10 cents, then 20 cents, then 30 cents, then 40 cents etc etc.

After you, the whale owner, gets the ball rolling it keeps going up.

You the whale have an initial investment of $5,000 but after a while that initial investment if worth $50,000 because others have been suckered into buying your coin.

Now its time for you, the whale, to pull the rug out from under the suckers who purchased your coin.

All of a sudden you sell you $50,000 worth of you coin.

You make $45,000 off your initial investment.

The value of you coin falls.

You don’t care because you have taken the money and now you can run.

The other investors have lost most of their money put into your coin.

They were suckered into buying you coin.

This is the ONLY thing a crypto coin is really good for is scamming people out of money.

Its the same with an NFT token.

A whale does the same thing with the NFT token and then takes the money and runs.

My advise.

Make a crypto coin if you want to but don’t waste money investing in it unless you plan on trying to be a whale scam artist.

Buy crypto if you want to.

At any time you could have the “rug” pulled out under you and your left with little to nothing.

Find something of real value to invest in.

Crypto has NO real value.

Nothing backs the coin value up.

Its ONLY worth what your willing to pay for it at that moment.

The next moment it could go up or down.

No real value.

There is “real value” in a memorial NFT Token that was made to honor someone.

There is real value in the NFT Token I created listed below.

My memories of my Dad and honoring him.

A memorial NFT token for my dad.

https://audaciouscat.com/rabbit/wwii-watch-a-11-hack-crypto-coin-01-12-2025/

Be sure to read the story connected with the Memorial NFT Token I created.

_____________________________________________________________